Why Does Your Business Need An Omni-Channel Loyalty Program?

5 December, 2024

26 Shopify BFCM Apps & Themes To Prepare Your Shopify Store In 2025

11 December, 2024Do you know to maximize the benefits of a loyalty program, it’s crucial to measure the ROI of loyalty programs? This blog will show you how to calculate the ROI of your program for small and large businesses with real examples.

Let’s find out!

What is the ROI of loyalty programs?

“Return on Investment,” or ROI, is a metric to measure loyalty program effectiveness by comparing its total costs to its net profit.

To calculate ROI, you need to weigh the benefits of your program, such as increasing sales or keeping customers happy, against the costs of running it, such as creating rewards or advertising.

Why is measuring the ROI of loyalty programs critical for e-commerce businesses?

To understand how well your loyalty program is working, you need to measure its ROI. The results will tell you if your strategy is paying off. If it is, you can keep doing what you’re doing and even try to do it even better.

If the good outweighs the bad, then your ROI is positive, and your program is a success.

How long should a loyalty program run before evaluating ROI?

We recommend waiting at least one year before checking ROI and how well your program is doing. By then, you should see some real results.

If your reward program doesn’t make money right away, don’t give up. For most people, it takes a while to get used to it and start getting benefits.

5 essential metrics to measure ROI of loyalty programs

There are several ways to find out how loyal your customers are. The best way for you will depend on what you need to find out. Keep an eye on these important things:

- Customer Lifetime Value (CLV) tells you how much money each customer usually spends with your business over time. Customers purchase more with a greater CLV.

- Average Order Value (AOV) shows how much customers spend on each order. A higher AOV means they’re buying more each time.

- Customer Retention Rate tells you how many customers stay with your business over time. A higher retention rate means your customers are sticking around.

- Incremental sales attributed to loyalty programs are the extra sales you get because of your loyalty program. It’s important to figure out how much of your sales are directly from the program.

- The cost of running the loyalty program includes the money you spend on rewards, marketing, and other things related to your loyalty program. Knowing these costs helps you figure out if the program is worth it.

Now that you know what to measure, let’s talk about how to calculate the ROI of your loyalty program in a small to medium-sized e-commerce business in our next part.

How to calculate the ROI of a loyalty program in a small-to-medium (SMB ) e-commerce business?

In this section, we’ll guide you through the steps involved in calculating ROI for your SMB loyalty program. We’ll talk about methods, and loyalty program ROI benchmarks for small businesses that will help you make smart choices.

Step 1: Define the key metrics

We already said that it takes time and work to figure out the ROI for your reward program. You should start by counting how much money your program has made. It’s simple: just check your sales records to see how much your regular customers have spent.

Here are some things to consider:

Customer Lifetime Value (CLV):

| CLV= (Average Annual Revenue per Customer)×(Average Customer Lifespan in Years) |

For example, if customers spend $300 a year and stay for three years, their CLV is $900.

Cost of running the loyalty program:

You need to calculate both direct costs (like rewards) and indirect costs (like technology and marketing).

- Direct costs: Points redemption costs, rewards given, administration fees.

- Indirect costs: Technology maintenance, marketing, and employee management.

If you spend $10,000 on rewards and $5,000 on other costs, your total program costs are $15,000.

Incremental sales attributed to the program:

You can find this by comparing your sales before and after you started the program.

Your extra sales are $50,000 if your sales went from $150,000 to $200,000 after you started the program.

Step 2: Calculate the ROI

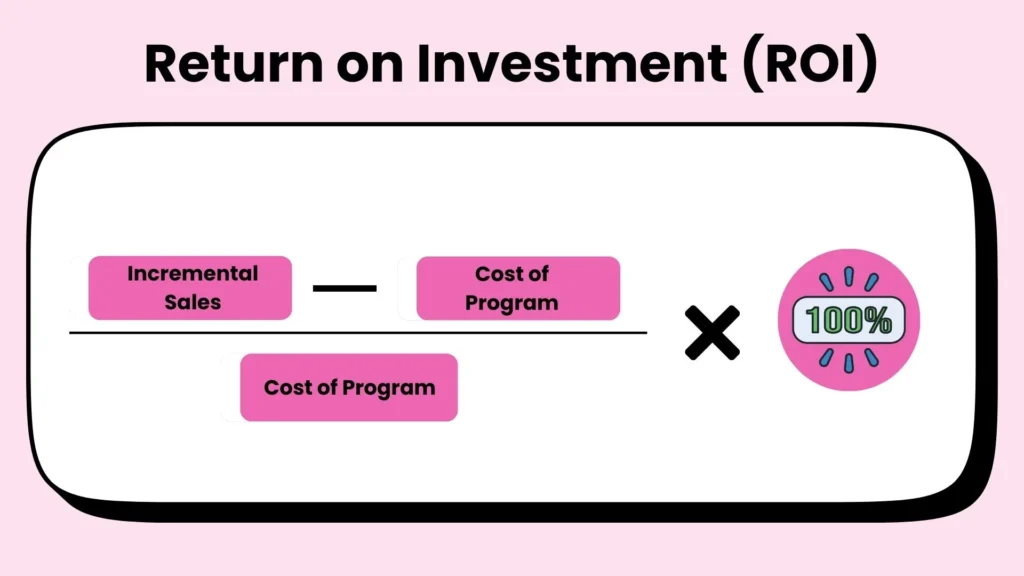

This formula below essentially measures the ratio of the net profit generated by the loyalty program to the total cost of running it.

| ROI = (Incremental Sales – Cost of Program) / Cost of Program * 100 |

Step 3: Analyze and interpret the results

If your ROI is positive, it means that the reward program is making money, no matter what method is used.

If the ROI is negative, it means that the program costs more than it makes.

Here are some key points to consider when interpreting ROI results:

- ROI benchmarking. Comparing loyalty program ROI across different industries benchmarks or historical data to assess its performance relative to others.

- Trend analysis. Analyze ROI over time to identify trends and areas for improvement.

- Goal alignment. Check whether the ROI aligns with your business objectives and expectations.

- Qualitative factors. Consider qualitative factors such as customer satisfaction, brand loyalty, and increased engagement, which may not be fully captured in the ROI calculation.

Let’s say your business spends $10,000 on a reward program that brings in an extra $15,000 in the first year.

| ROI = ($15,000 – $10,000) / $10,000 * 100 = 50% |

Therefore, your company’s loyalty program generated a 50% ROI in the first year. This means that for every $1 invested in the program, your company earned an additional $1.50 in revenue.

In this case, this indicates a strong return on investment for the loyalty program.

Step 4: Include qualitative insights

While ROI is important, it’s not the only thing to consider when evaluating your loyalty program. You should also look at:

- Customer engagement due to rewards.

- Redemption Rates, if high, indicate active participation.

- Customer feedback can signify satisfaction with the program.

Here are some ways to do this:

First, ask for feedback. We have a list of 14 ways to get more customer reviews in a different post.

Then, analyze their behavior. See how their behavior has changed since you started the program.

3 steps to calculate ROI using CLV and CAC for an enterprise-level loyalty program

So, we have learned how to calculate ROI in the context of loyalty programs for small and medium enterprises. However, for large companies, a different formula will be needed.

Step 1: Define the key metrics

Just like small and medium-sized businesses, large businesses will need to calculate Customer Lifetime Value (CLV), Customer Acquisition Cost (CAC), and Program Cost per Customer using the following formula:

Customer Lifetime Value (CLV):

| CLV = (Average Purchase Value) × (Number of Purchases per Year) × (Customer Lifespan) / Gross Margin Percentage |

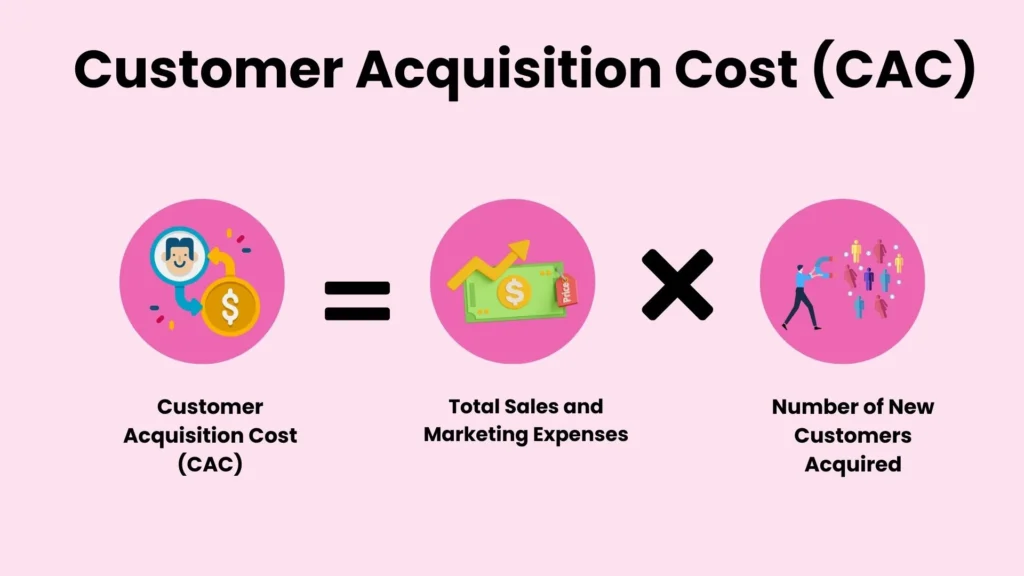

Customer Acquisition Cost (CAC):

| CAC = Total Sales and Marketing Expenses / Number of New Customers Acquired |

Program Cost per Customer:

| Program Cost per Customer = Total Loyalty Program Costs / Number of Customers Enrolled |

Let’s say each customer spends $300 a year, stays for four years, and it costs $400 to get them to shop there. The loyalty program costs $20 per customer.

- CLV: $300 x 4 = $1,200

- CAC: $200,000 / 500 = $400

- Program Cost per Customer: $100,000 / 5,000 = $20

Now, you have all the numbers you need to calculate the ROI of your loyalty program.

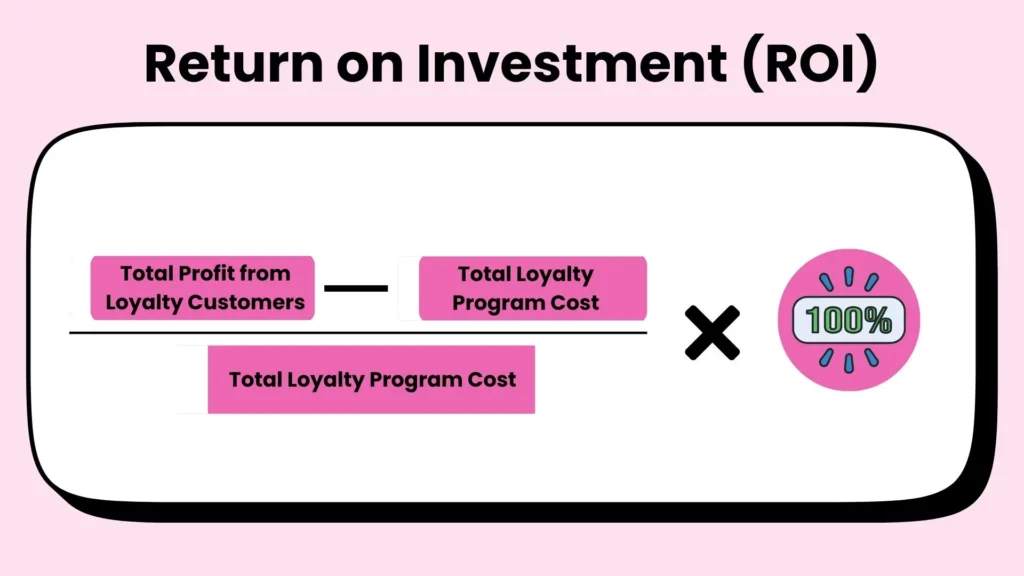

Step 2: Calculate the ROI using CLV and CAC

To get a good idea of how well your reward program is working, you need to figure out how much money each person brings in and the general ROI. This is called profit per customer.

| Profit per Customer = CLV – CAC – Program Cost per Customer |

For example:

Each customer pays $7,143, the program costs $20 per customer, and getting them to shop there costs $400. This means that the earnings per customer is $7,143 – $400 – $20 = $6,723.

Then, you can calculate the ROI of the Loyalty Program.

| ROI = (Total Profit from Loyalty Customers – Total Loyalty Program Cost) / Total Loyalty Program Cost * 100 |

If a customer is worth $7,143, getting them to shop costs $400, and the reward program costs $20 per customer, then the business makes $6,723 from each customer.

Step 3: Analyzing and interpreting the ROI

After calculating the ROI index, we compared our ROI of loyalty programs to both our original goals and industry standards to see how well it worked.

What is a good ROI of a loyalty program?

According to the Antavo Global Customer Loyalty Report 2024, 90% of program owners reported a positive ROI, with an average value of 4.8X. This suggests that our program’s ROI is substantially higher than the industry average, confirming its effectiveness.

We found that for every $1 spent on the points program, we generated $335.15. This impressive ROI indicates that the loyalty program is highly effective and contributes significantly to our bottom line.

Measuring success beyond ROI: how to track and improve your loyalty program’s performance

This part talks about more than just ROI. It also talks about important qualitative measures and best practices for making sure your award program works well.

Understanding qualitative metrics for evaluating program success

We already said that a high ROI is a good sign, but it’s also important to look at other things, like how happy the customers are and the long-term benefits such as:

- Engagement rate measures how often customers interact with your loyalty program. A high engagement rate means that customers are taking part in the program and finding it useful.

- The redemption rate tracks the percentage of points or rewards earned that customers redeem. A high redemption rate means that the benefits are appealing and encourage people to take part in the program.

We have a detailed article on the top 10 customer loyalty KPIs businesses should track for your reference.

4 Strategic tips for improving ROI and boosting program effectiveness

To make sure your loyalty program keeps working and gives you the best return on investment, you need to take smart steps that get customers more involved, cut costs, and use technology. We suggest:

- Personalization tactics to each customer’s likes and dislikes based on their past purchases, personal information, and other relevant data. This helps make rewards for loyalty programs more useful and successful.

- Send personalized messages and promotions to customers based on their interests and interactions with your brand. This can enhance customer engagement and drive repeat purchases.

- Optimize the rewards structure of different rewards and adjust your program accordingly. Consider offering rewards that are valuable to customers but don’t break the bank for your business.

- Use strong loyalty program software to collect consumer data, automate processes, and deliver important insights. At 10+ loyalty programs software for small companies, you may discover the ideal app.

3 common misconceptions in calculating the ROI of loyalty programs you must know

Three common myths about the ROI of loyalty programs will be discussed in this section, along with tips on how to avoid these problems.

Overlooking important metrics when calculating ROI

When you’re figuring out how well your loyalty program is doing, it’s important to track everything. Some businesses forget to look at how many customers stay loyal and how much extra money they make because of the program.

You might get the wrong idea about how good your program is if you don’t do these things. This can cause people to make bad choices and miss chances to make things better.

Assuming a higher redemption rate always means better ROI

High redemption rates can be a good sign, but they don’t always mean you’re making more money. Sometimes, it might mean your rewards are too expensive, which can cost you more and reduce your profit.

Check out how much the benefits make you and how much they cost you. If they work well, this will tell you. Also, keep track of how often and how much each person spends.

Believing ROI is the only measure of loyalty program success

The truth is that ROI is not the only factor to consider when assessing the success of a loyalty program. Additionally, you should take into account factors like consumer satisfaction, frequency of brand interactions, and lifetime spending.

Final thoughts

To know how well your loyalty program is working, you need to track the ROI of loyalty programs and how much it costs. By doing this, you can figure out how to make it even better.

If you have a Shopify shop and want an app for a reward program, BON Loyalty could be a good choice. It’s a great choice that works well with Shopify and comes with everything you need to make your reward program work.

Lindsey Nguyen is a Content Marketing Specialist at BON Loyalty, specializing in digital marketing and eCommerce. At BON Loyalty, she crafts content that empowers Shopify store owners to build and sustain thriving customer relationships through innovative loyalty programs. Her articles, often featured on the BON Loyalty blog, provide valuable strategies and insights that help businesses enhance customer loyalty and increase customer lifetime value.